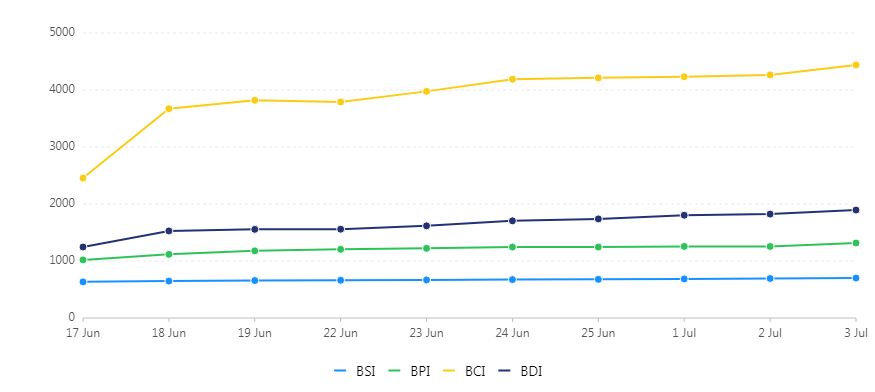

The increasing demand for vessels has seen the Baltic Dry Index (BDI) rising yet again as it reaches 1,823, its highest peak in 8 months, after an increase of 1.1%, the 25th straight trading session where it has seen an increase, according to the article published by Reuters. The continued rise of the index is a result of an increase in demand for seafaring vessels. The Baltic Dry Index (BDI) provides the benchmark of the cost of shipping materials by sea and is a combination of the index for three different types of dry bulk vessels, specifically capesize, panamax and supramax vessels.

The Baltic Dry Index (BDI) is a useful indicator for future growth as it measures demand for raw materials. The continued increase in the index is believed to have been propelled in part by the demand for iron ore in China as a result of factories resuming work following the lifting of lockdowns due to the COVID-19 pandemic. This has seen a spike in the index by more than 60% this year.

Usually used to transport coal or ore, capesize vessels are ships that have more than 100,000 deadweight tonnage (DWT). These are the biggest vessels of the three, and can even go up to 400,000 DWT, although they typically have 170,000 to 180,000 DWT. The Baltic capesize index increased by 0.7% to 4,264, and daily earnings for capesize vessels also increased by 1.4% to $31,377.

Panamax vessels, which range from 60,000 to 70,000 DWT, also saw demand increase as the panamax index edged upwards by 2 points. Panamax vessels, so named due to their dimensions being the maximum size for ships travelling through the Panama Canal, are usually used to transport goods such as grain and coal. Daily earnings for panamax vessels also increased by 0.17% to $11,317.

Supramax vessels, which carry cargo from 45,000 to 60,000 DWT and are the smallest of the three types of vessels, also saw its index increase by 1.3% to 693.